Fresh Book Software Review: Cloud Accounting, Invoicing & Workflow Management

Introduction

Efficient financial management is essential for freelancers, consultants, and small businesses. Cloud-based accounting tools allow users to automate invoicing, monitor expenses, and generate financial reports without relying on complex manual bookkeeping systems.

Fresh Book is widely discussed as a cloud accounting solution designed for independent professionals and small teams. This article provides a structured, informational overview of fresh book, its capabilities, and key evaluation factors. The content is educational and does not constitute financial advice.

What Is Fresh Book?

FreshBooks is a cloud-based accounting platform that focuses on invoicing, expense management, and financial reporting. Fresh book software is commonly used by freelancers and small service-based businesses seeking streamlined bookkeeping tools.

The platform operates via web access and mobile applications, allowing financial tasks to be managed remotely.

Platform Dashboard & User Experience

4

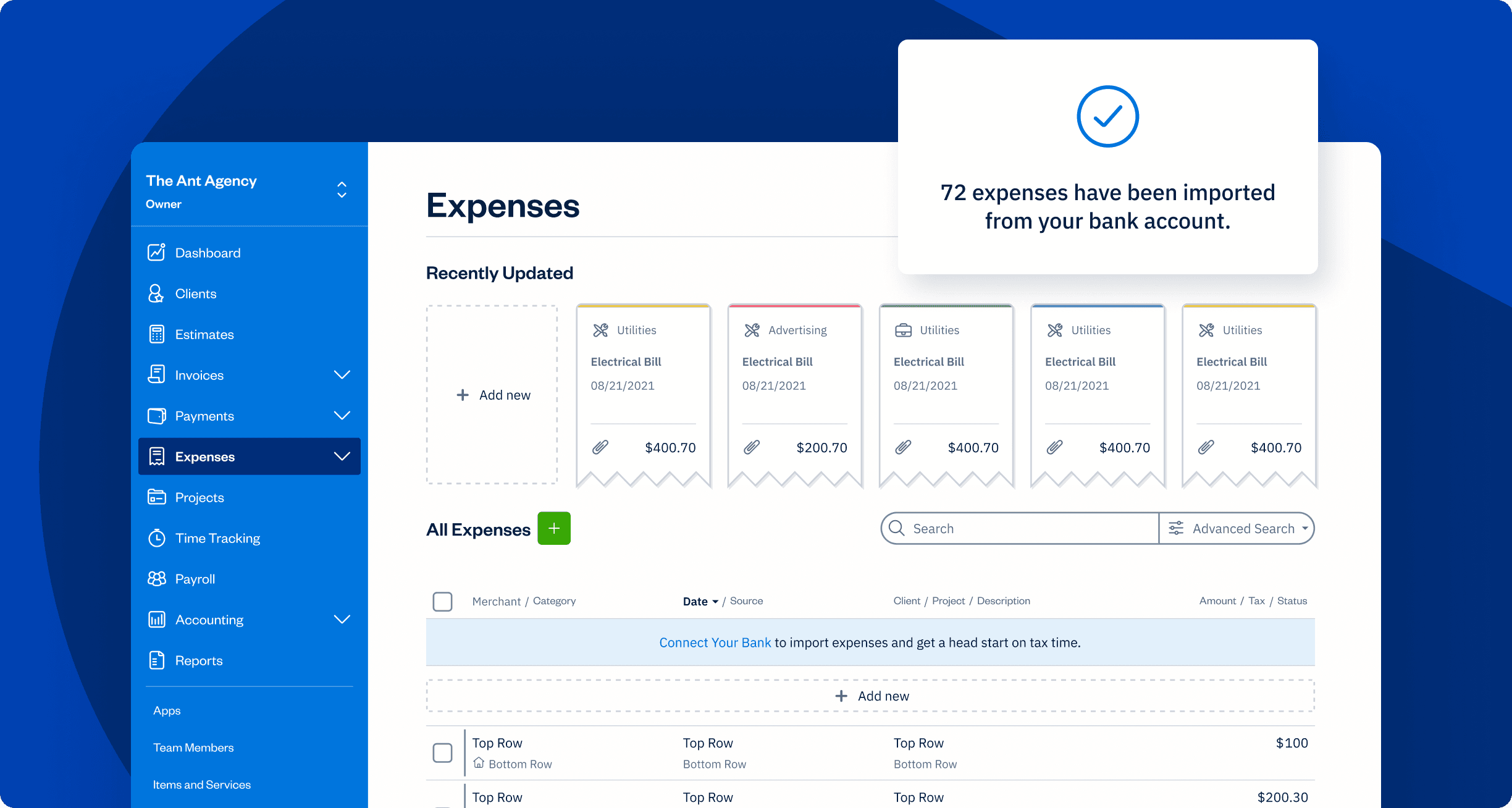

The fresh book dashboard typically displays:

- Revenue summaries

- Outstanding invoices

- Expense breakdowns

- Client account information

- Reporting shortcuts

The interface is structured to simplify navigation for non-accounting professionals.

Invoicing Automation

Fresh book invoicing tools may allow users to:

- Create branded invoices

- Set recurring billing schedules

- Apply tax rates

- Track invoice status

- Send automated reminders

Online payment acceptance may depend on region and third-party payment integrations.

Expense Management

Users can generally:

- Upload and categorize receipts

- Link bank accounts (where supported)

- Monitor operating costs

- Generate expense reports

Automated categorization can reduce manual bookkeeping errors.

Time Tracking & Client Billing

Fresh book often includes time-tracking features that enable users to:

- Log billable hours

- Attach time entries to projects

- Convert tracked time into invoices

- Monitor project budgets

This feature benefits consultants and agencies billing by the hour.

Reporting & Financial Visibility

The platform may generate financial reports such as:

- Profit and loss statements

- Tax summaries

- Accounts receivable aging reports

- Expense trend analyses

Reports help businesses assess financial performance and prepare documentation for tax professionals.

Integrations & Connectivity

Fresh book may integrate with:

- Payment processing services

- Banking institutions

- Payroll tools

- Third-party productivity platforms

Integration options vary by subscription plan and region.

Security & Data Protection

Businesses evaluating fresh book should review:

- Data encryption protocols

- Multi-factor authentication options

- Backup and recovery procedures

- Compliance documentation

Sensitive financial data requires secure handling and proper oversight.

Fresh Book vs Traditional Accounting Methods

| Feature | Manual Bookkeeping | Fresh Book |

|---|---|---|

| Cloud Access | No | Yes |

| Automated Invoicing | Limited | Supported |

| Expense Tracking | Manual | Automated |

| Real-Time Reporting | No | Yes |

| Mobile Access | No | Yes |

Cloud-based accounting tools can reduce administrative burden.

Who May Consider Fresh Book?

Fresh book may be suitable for:

- Freelancers

- Independent consultants

- Small service-based businesses

- Creative professionals

- Startups with basic accounting needs

Larger enterprises with complex accounting structures may require additional systems.

Implementation Strategy

Before adopting fresh book:

- Compare available pricing tiers.

- Review integration requirements.

- Confirm tax reporting compatibility.

- Provide basic accounting training to users.

- Conduct regular financial reviews.

Structured implementation supports long-term usability.

Conclusion

Fresh book is a cloud-based accounting platform offering invoicing, expense management, time tracking, and reporting tools designed for freelancers and small businesses. Organizations evaluating fresh book should assess features, pricing, compliance considerations, and integration needs before implementation.

This content is informational and does not constitute financial or tax advice.