Fresh Book Accounting Software: Features, Pricing Structure & Business Workflow

Introduction

Managing finances efficiently is critical for freelancers, consultants, and small business owners. Cloud-based accounting platforms simplify invoicing, expense tracking, and reporting while reducing manual bookkeeping work.

Fresh Book is frequently referenced as a user-friendly accounting solution designed for independent professionals and growing service businesses. This article provides a structured and informational overview of fresh book, focusing on features, operational benefits, and practical considerations. This content is educational and does not constitute financial advice.

What Is Fresh Book?

FreshBooks is a cloud accounting platform offering tools for invoicing, expense tracking, time management, and financial reporting. Fresh book software is primarily designed for freelancers and small service-based businesses seeking simplified financial management.

The platform is accessible through web browsers and mobile applications, enabling remote access to accounting workflows.

User Interface & Dashboard Overview

The fresh book dashboard typically includes:

- Revenue and invoice summaries

- Expense tracking widgets

- Client management panels

- Reporting shortcuts

- Time tracking overview

The interface is designed to be intuitive for users without formal accounting training.

Invoicing Capabilities

Fresh book invoicing tools may allow users to:

- Create professional, branded invoices

- Automate recurring billing

- Apply tax rates and discounts

- Track payment status

- Send automated reminders

Online payment acceptance options may vary by region and integration provider.

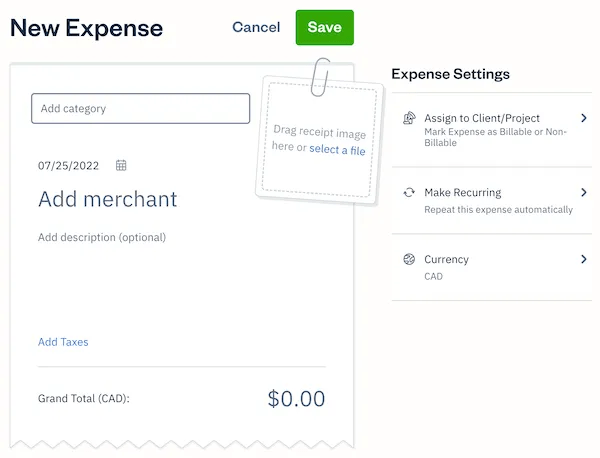

Expense Management

Users can typically:

- Upload receipts digitally

- Categorize expenses

- Connect bank accounts (where supported)

- Generate expense summaries

Automated categorization helps improve bookkeeping accuracy.

Time Tracking & Client Billing

Fresh book may include time-tracking features that enable users to:

- Log billable hours

- Assign time to projects

- Convert tracked time into invoices

- Monitor project profitability

This feature is especially useful for consultants and agencies billing by time.

Financial Reporting

Fresh book reporting tools may generate:

- Profit and loss statements

- Accounts aging reports

- Tax summaries

- Expense trend analysis

These reports assist in monitoring financial performance and preparing documentation for tax professionals.

Integrations & Compatibility

Fresh book may integrate with:

- Payment processors

- Payroll systems

- Banking institutions

- Productivity and CRM tools

Integration availability depends on subscription tier and geographic location.

Security & Data Protection

Businesses evaluating fresh book should review:

- Encryption protocols

- Multi-factor authentication options

- Backup policies

- Compliance documentation

Financial data security is essential for regulatory and operational integrity.

Fresh Book vs Manual Bookkeeping

| Feature | Manual Accounting | Fresh Book |

|---|---|---|

| Cloud Access | No | Yes |

| Automated Invoicing | Limited | Supported |

| Expense Categorization | Manual | Automated |

| Real-Time Reports | No | Yes |

| Mobile Access | No | Yes |

Cloud accounting tools can streamline administrative tasks.

Who May Benefit from Fresh Book?

Fresh book may be suitable for:

- Freelancers

- Small service-based businesses

- Consultants

- Creative professionals

- Early-stage startups

Complex enterprises may require additional accounting systems.

Implementation Tips

Before adopting fresh book:

- Compare pricing tiers.

- Review integration requirements.

- Confirm tax reporting compatibility.

- Train team members on platform features.

- Conduct regular financial audits.

Proper setup improves long-term effectiveness.

Conclusion

Fresh book is a cloud-based accounting solution offering invoicing, expense management, time tracking, and reporting tools tailored to freelancers and small businesses. Organizations considering fresh book should evaluate features, pricing structure, compliance requirements, and integration needs before implementation.

This article is informational and does not constitute financial or tax advice.