Fresh Book Software Overview: Invoicing, Expense Tracking & Small Business Accounting

Introduction

For freelancers and small business owners, managing invoices and expenses efficiently is essential. Cloud-based accounting platforms provide automation, reporting, and financial visibility without the complexity of traditional accounting systems.

Fresh Book is commonly referenced as an accessible accounting solution tailored to service-based professionals. This article offers a structured, neutral overview of fresh book, explaining its features, workflow benefits, and considerations before adoption. The information below is educational and does not constitute financial advice.

What Is Fresh Book?

FreshBooks provides cloud accounting software designed to simplify invoicing, expense tracking, and financial reporting. Fresh book solutions are typically aimed at freelancers, consultants, and small businesses seeking streamlined bookkeeping tools.

Users can access the platform through web browsers and mobile applications for remote financial management.

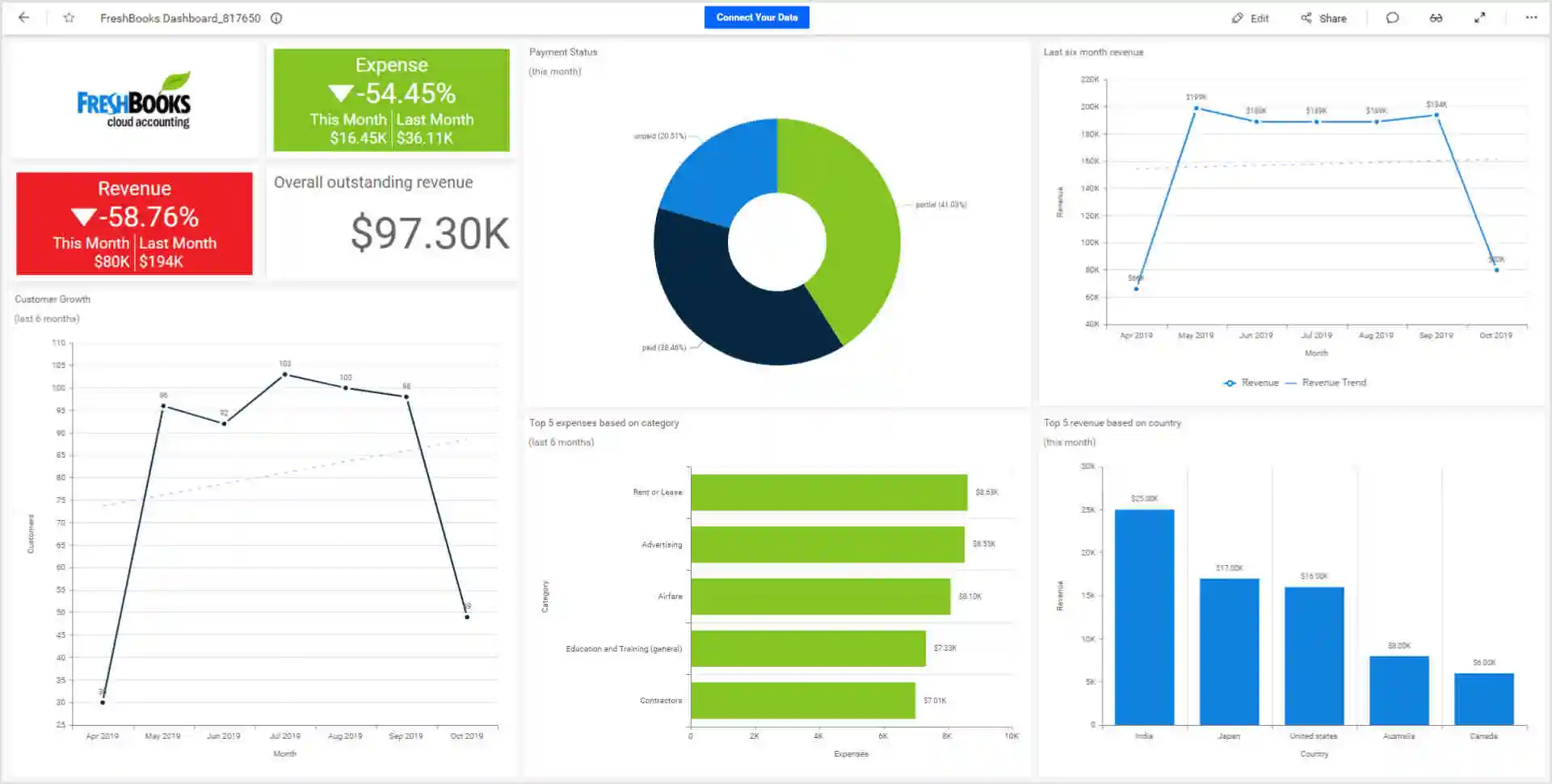

Platform Dashboard & Navigation

4

The fresh book dashboard generally includes:

- Revenue summaries

- Outstanding invoice tracking

- Expense categorization panels

- Client account management

- Quick access to financial reports

The layout emphasizes usability for non-accounting professionals.

Invoicing & Payment Tools

Fresh book invoicing features may allow users to:

- Design custom invoice templates

- Set up recurring billing cycles

- Apply taxes and discounts

- Monitor invoice status

- Send automatic reminders

Payment processing integration depends on supported third-party providers and regional availability.

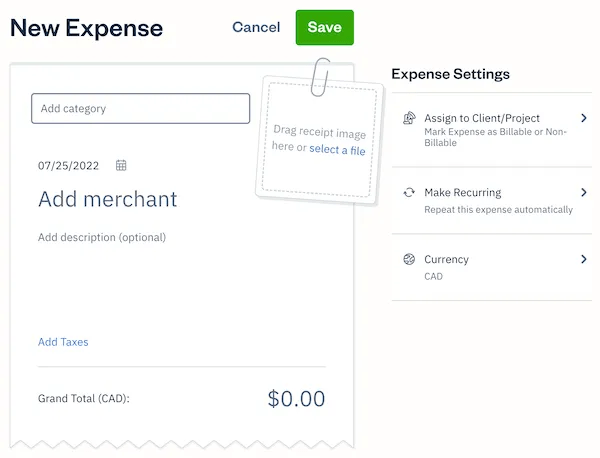

Expense Management

Users can typically:

- Upload receipts digitally

- Categorize expenses automatically

- Connect bank accounts (where supported)

- Review expense summaries

Automated expense tracking helps reduce manual data entry.

Time Tracking & Client Billing

Fresh book may include time-tracking functionality that enables users to:

- Record billable hours

- Assign time to projects or clients

- Convert logged hours into invoices

- Analyze project profitability

This feature supports service-based billing models.

Reporting & Financial Analysis

Fresh book reporting tools may provide:

- Profit and loss statements

- Accounts receivable aging reports

- Tax summaries

- Expense analysis charts

Reports assist in evaluating business performance and preparing documentation for professional accountants.

Integrations & Compatibility

Fresh book may integrate with:

- Payment gateways

- Payroll platforms

- Banking services

- Business productivity applications

Integration options vary by subscription tier and region.

Security & Data Protection

Organizations evaluating fresh book should review:

- Encryption standards

- Multi-factor authentication availability

- Data backup procedures

- Compliance documentation

Secure handling of financial information is critical for operational integrity.

Fresh Book vs Traditional Methods

| Feature | Traditional Bookkeeping | Fresh Book |

|---|---|---|

| Cloud Access | No | Yes |

| Automated Invoicing | Limited | Supported |

| Expense Categorization | Manual | Automated |

| Real-Time Reporting | No | Yes |

| Mobile Accessibility | No | Yes |

Digital tools can streamline bookkeeping workflows.

Who May Consider Fresh Book?

Fresh book may be suitable for:

- Freelancers

- Consultants

- Small service-based businesses

- Creative professionals

- Startups with straightforward accounting needs

Larger organizations with complex accounting structures may require more advanced solutions.

Implementation Considerations

Before adopting fresh book:

- Compare pricing plans and features.

- Review integration requirements.

- Confirm tax reporting compatibility.

- Train users on accounting basics.

- Conduct regular financial reviews.

Proper planning improves long-term efficiency.

Conclusion

Fresh book is a cloud-based accounting platform offering invoicing automation, expense tracking, time management, and reporting tools designed for freelancers and small businesses. Businesses evaluating fresh book should assess subscription options, integration compatibility, and compliance considerations before implementation.

This article is informational and does not constitute financial or tax advice.